Transport and logistics industry to see varying recovery levels

Its nature is dependent on other industries, as well as global economic activities.

With many countries slowly recovering from the impacts of the COVID-19 pandemic, industries have also become acclimated to the new ways of doing business. New business models have been introduced, digital transformation has accelerated, and even people have shifted their demands to the needs of the times.

Similarly, the transport and logistics industry has managed to keep up with the economy, gradually resuming operations and incorporating different strategies to adapt to the new normal. However, as a downstream industry that is dependent on the activities of other industries, transport and logistics’ recovery is expected to be at varying degrees due to the pandemic.

For the remainder of the year, the industry will be facing a tough road ahead. Sub-sectors would have to make sure that their businesses are stable, that they respond effectively to new mobility habits, and that their core logistics operations are entering digitalisation. With the need to conform to the way other industries do business today, companies in the transport and logistics industry would have to rethink their business models further.

Singapore to promote EV uptake

A report from Fitch Solutions pointed out that as Singapore’s automotive sales market enters its growth cycle, the wealthy population and the government will prioritise the purchase of electric vehicles (EV) over internal combustion-engined (ICE) vehicles.

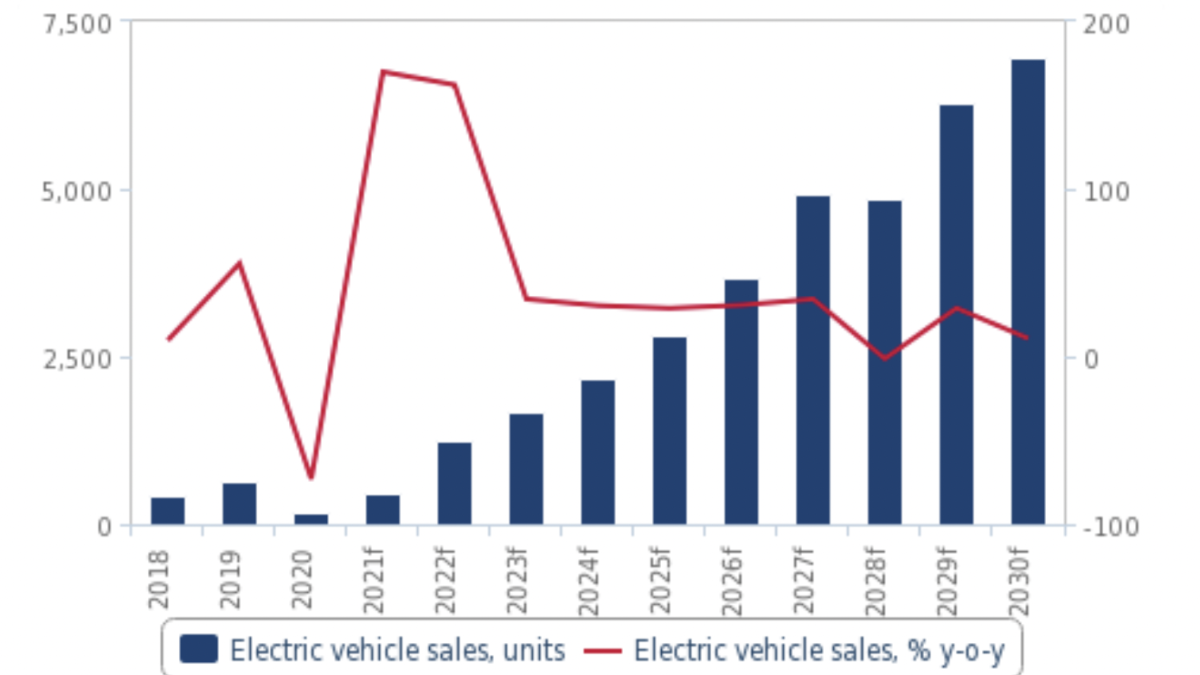

They forecast that EV sales in Singapore will expand by 170% YoY in 2021 to reach an annual sales volume of just 475 units. This represents a strong expansion following a 73% YoY decline in EV sales over 2020. They also expect EV sales to continue to grow at an average annual rate of 40% YoY over 2022 to 2030 to reach an annual sales volume high of just under 7,000 units and an EV penetration rate of around 9.6% of total vehicle sales.

“That said, we note that there is room for stronger growth given the wealthy population, especially as the cost of EVs moderates in Singapore and as the cost of ICE-vehicle ownership rises,” Fitch Solutions stated in the report.

Furthermore, Fitch Solutions mentioned that the government will also accelerate the development of its nascent EV-charging infrastructure which will further motivate consumers and fleet operators to make the shift from ICE to EVs as it becomes more user-friendly in the city-state.

Since the 2020 Budget, Singapore has announced to phase out ICE vehicles by 2040 through increased incentives, with charging infrastructure for EVs deemed to be feasible due to the wealthy population, small fleet size, and relatively long-term target.

To support the transition, the government has set up a National Electric Vehicle Centre and announced several incentives including a $30m budget for EV initiatives over the next five years and adjustments to registration fees and road tax for EVs to make them more affordable. The hike in petrol duties was also a part of this strategy to both reduce the number of cars and accelerate the transition to EVs.

They have also announced a range of financial incentives to promote the uptake of EVs.

Amongst Singapore’s plans to achieve this goal is the expansion of its upfront rebate of up to $27,266 (US$20,000) and $40,899 (US$30,000) for car buyers and taxi operators who buy EVs or hybrid vehicles, to include a scheme called the Commercial Vehicle Emissions Scheme for light goods vehicles.

For cars and taxis, the government will provide an EV Early Adoption Incentive in which electric cars and taxis will receive a rebate of up to 45% on the Additional Registration Fee, capped at $27,266 (US$20,000), which will run from three years from January this year.

Singapore will also revise its road tax methodology for cars to better reflect the current trends in vehicle efficiency from January, which will lead to an across-the-board reduction in road tax for EVs and some hybrids.

The government will push to expand the public charging infrastructure for EVs, which currently only sits at 1,600 charging points. By 2030, the government aims to deploy up to 28,000 chargers at its public car parks throughout the island. They have stated that it will take the lead in driving EV adoption by progressively procuring and using EVs.

Fitch Solutions believe that the recent announcements of the Singapore government would boost the demand for EVs over their 2020 to 2029 forecast.

Moreover, the agency noted that Singapore's vehicle sales market is very cyclical given the high cost of vehicles, the bidding process of obtaining ownership, as well as the restrictions on vehicle fleet size.

New vehicles in Singapore cost significantly more than they would in a comparative market due to the need for vehicle buyers to first obtain a Certificate of Entitlement (COE), giving the holder the right to own and use a vehicle for 10 years, through public auctions which cost between $54,530 (US$40,000) to $81,783 (US$60,000) for passenger vehicles.

On top of the COE cost, vehicles tend to be more expensive in Singapore due to the additional costs of importing new vehicles ranging from basic import duties, goods and service tax, additional registration costs, and emissions-related expenses.

“We believe that the growth cycle (or replacement cycle) of Singapore's new vehicle sales market will start in 2021 and enter full force over 2022, which will likely see EV adoption accelerate if the government has the necessary EV charging infrastructure in place and if it follows through with its plan to reduce the cost of EVs,” Fitch Solutions said.

They see that the high cyclical sales market is an indication that EV adoption could become rapid in the next few years. They also expect an acceleration of EV charging infrastructure developments over 2021 to 2025, as the government looks to provide more support to its nascent EV industry.

The Singapore Green Plan aims to install 60,000 EV charging points by 2030 with 8 EV-ready towns by 2025, more than double its previous plans to install just 28,000 charging points over the same period.

“We note that this is a highly ambitious target, given that Singapore only has approximately 1,600 charging points at present. This translates into around one charging point per EV in Singapore's vehicle fleet, whilst currently, this ratio is somewhat supportive of the current EV fleet, the charging network will have to expand geographically and in the number of charging points to attract more consumers to EVs and to make EVs more usable over the entire city-state,” Fitch Solutions stated.

Meanwhile, the EY Mobility Consumer Index found that more than half (55%) of Singapore consumers looking to buy a car in the next year are planning to purchase an EV, with 66% of Singapore consumers and 91% amongst those planning to buy an EV are willing to pay a premium.

“Most consumers are willing to pay a premium for an EV, either due to environmental concerns or an understanding that the long-term costs will likely be lower. This is a fundamental shift in attitudes, which is ultimately beneficial for consumers and the planet,” EY Global Transport Leader Tony Canavan said.

Benjamin Chiang, EY Asean and Singapore Government and Public Sector leader, said many of those who adopted EV in Singapore are homeowners and had their own charging points.

“The Singapore government aims to deploy 60,000 EV charging points across the country by 2030. Assuming the car population remains constant and a third are EVs, this translates into a ratio of about five EVs to every charging point in 2030. There are lingering concerns whether this is sufficient to meet demand,” Chiang said.

Demand for logistics rise amidst trade recovery

For the logistics industry, the leading global brand, DHL, foresees a strong and sustained growth in cross-border road transportation in Southeast Asia where the e-commerce sector is expected to grow 5.5% in 2021. The predicted upswing is also driven by the renewed growth in many of Southeast Asia's leading economies, as manufacturing rebounds and companies regionalise and diversify their supply chains.

“With the easing of trade restrictions and implementation of new regulatory initiatives in the region such as the ASEAN Customs Transit System and Regional Comprehensive Economic Partnership, trade cooperation will continue to strengthen and bolster intra-Asia trade. This augurs well for ASEAN countries as they gear up to bounce back strongly from the COVID-19 pandemic," CEO, DHL Global Forwarding Asia Pacific CEO Kelvin Leung said.

UOB Kay Hian also forecasts that the growth of e-commerce will drive demand for more logistics space.

“Online retailers are heavy-duty users of [the] logistics space. Online retail sales are supported by 3x the logistics space required for brick-and-mortar retail sales,” UOB Kay Hian said in a note.

They noted that Singapore Exchange-listed firm Frasers Logistics & Commercial Trust (FLCT) is investing in expansion in logistics and business park properties.

“In the near term, management sees opportunities to create value of its CBD Commercial properties through active asset management to optimise rents and occupancy but is unlikely to hold on to them over the longer term. FLCT is likely to rebalance its asset class mix towards logistics and business park properties over the next three to five years,” it said.

It should be pointed out that the logistics sector is a key pillar of Singapore’s economy. In 2019, it contributed to 1.4% of the country’s gross domestic product.

“As Singapore is a major transhipment hub and serves as a gateway to some of the key regions, any changes in the global shipping industry affect Singapore's logistics market, majorly in sea and air,” according to a report by market research firm Mordor Intelligence.

The firm anticipates the Singapore logistics market to register a growth rate of 5% from 2021 to 2026.

“Government agencies have worked to ensure that any disruptions in Singapore's supply chain network are quickly overcome by providing options in other parts of the network. Singapore has moved toward higher value-added logistics services such as contract logistics that provide customised and end-to-end solutions for companies,” Mordor Intelligence stated.

The Singapore government continues to invest in transport infrastructure to maintain the country’s position as a world-class city, and they will also continue to develop the country’s supply chain capabilities.

Several government agencies are expected to work with the logistics industry to value-add to cold-chain management, retail, and pharmaceutical logistics. A data infrastructure foundation will be built up for sharing secure data across supply chains.

Meanwhile, real estate services company JLL noted in their report that there is a firm demand for warehouse space, driven largely by renewals and relocations, and with future demand for logistical facilities to be driven by the business growth of logistics service providers as well as industrialists and end-users.

They also noted that logistics rent remains under pressure because of high vacancy brought by the pandemic, although they have broadly stabilised. “Transactional evidence remains limited. Despite strong investor sentiment, yields have remained stable over 2018,” the firm said. JLL mentioned that the rental value stands at $1.36 per square foot per month, gross effective on NLA.

The net absorption of the logistics market is expected to outpace supply. JLL forecasts moderate logistics rental growth next year as vacancy falls amidst tapering new supply, and that the limited buying opportunities, amidst a rental recovery, could result in marginal yield compression for logistics and warehouse assets.

Advertise

Advertise