Cards & Payments

S’pore’s payment cards lead with 40% market share in online transactions

An analyst said Singapore’s advanced tech infrastructure has boosted alternative payments.

2 days ago

S’pore’s payment cards lead with 40% market share in online transactions

An analyst said Singapore’s advanced tech infrastructure has boosted alternative payments.

2 days ago

DCS Card Centre secures add’l $100m upsize in asset-backed notes

The funds will be allocated to finance DCS's receivables from retail and corporate customers.

DCS Card Centre launches new digital innovation unit

Ceridwen Choo has been appointed as CEO of DCS Innov.

Around 38,000 accounts activate ‘Money Lock’ feature

The activation resulted in over $3.2b of savings that were set aside.

YouTrip introduces new stock and flow limits for improved digital wallet experience

Users can enjoy a wallet limit of S$20,000 and an annual spending limit of S$100,000.

DCS Card Centre raises $300m in upsized asset-backed notes offering

DBS and First Plus Asset Management supported the transaction.

Almost half of businesses say better fintech solutions are the answer to their top issues

Many B2B businesses have yet to adopt digital payment solutions.

YouBiz unveils multi-currency corporate cards in Singapore

The card can be issued in 9 currencies without FX fees or monthly subscription fee.

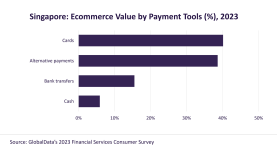

Chart of the week: alternative payments used in 1 in 3 online shopping transactions

Singapore’s e-commerce market is forecast to grow by 15% this year.

Singapore to eliminate use of all corporate cheques by 2025

Cheque transactions have declined by almost 70% between 2016 to 2022.

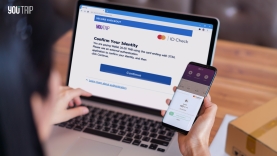

Kasikornbank, YouTrip ramp up online payment security with 3DS 2.0

70% of respondents said that they’ve adopted a more cautious stance in online payments.

HSBC SG partners with Mastercard for travel credit card

It aims to provide convenience for travellers due to the rise in post-pandemic traffic.

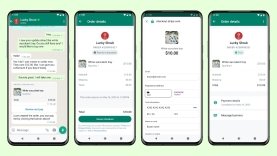

WhatsApp launches payment feature in SG

Users will be able to send payments to merchants.

Alipay+ accessible in 11,000 SG Hawker Centre stalls

Users of the platform and partner e-wallets can pay through the SGQR.

BNPL platforms risk losing trust by ignoring SFA Code of Conduct

Under the Code of Conduct, BNPL providers need to show customers their ‘Trustmark’.

Visa appoints Adeline Kim as Singapore, Brunei country manager

She was most recently head of data solutions for Asia Pacific.

Meaningful experiences, wellness as key pillars of the return of travel: Mastercard’s Mayank Dutt

Mastercard’s cardholders in its affluent portfolio can access wellness programs on the go.

Advertise

Advertise